CANSTAR Credit Cards Star Rating - Report #24 - April 2013

YOUR GUIDE TO PRODUCT EXCELLENCE

AT LEAST $17 BILLION IN INTEREST OVER THE PAST FIVE YEARS

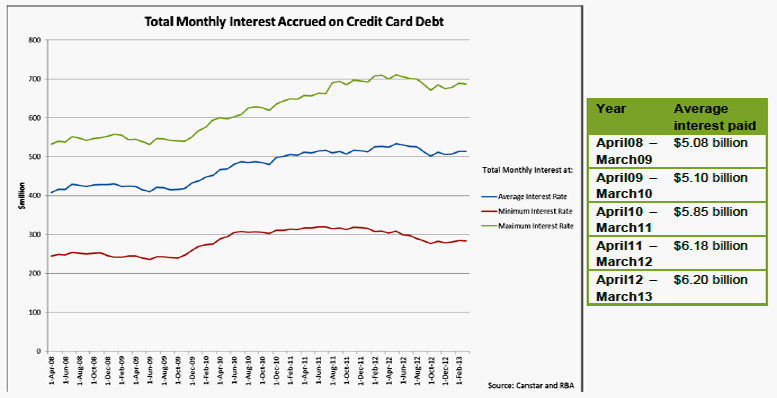

With around $50 billion currently owed on credit cards – and $36 billion of that accruing interest – there is no doubt that our love affair with the plastic fantastic continues.

Notwithstanding the low interest rate environment and our improved personal saving profile, our analysis of official statistics reveal that Australians have paid between $16.9 billion at a minimum and $37.1 billion as a maximum in credit card interest charges over the past five years. Based on the average credit card interest rate each month across all providers, the average amount of credit card interest paid over the past five years is approximately $28.4 billion.

The graph below shows what the maximum interest paid and minimum interest paid per month would be, based on the lowest-rate card on the market at the time, the highest-rate card on the market at the time and the average interest rate charged across all providers.

IN THIS REPORT

We research & rate:

•

181 credit cards offered by•

67 lendersto determine the cards offering the best value for consumers across four spending profiles.

The Federal Government’s National Consumer Credit Protection (NCCP) Act, which came into effect in July last year, offers some protection for credit card users, including:

•

A ban on invitations to increase your credit limit, unless you have agreed to receive these invitations.•

No fee on a new card when your card goes above the credit limit, without first getting your agreement.•

Provision of a 'key facts sheet' when you apply for a credit card. The facts sheet contains:How the minimum monthly repayment will be calculatedo

o

Any annual and late payment fees and the interest rate that applies to purchases, cash advances and balance transferso

Any promotional interest rateo

The length of any interest-free periodAnother more recent development relates to surcharge costs. In 2003 the RBA imposed Standards requiring the card schemes to remove their ‘no-surcharge’ rules. This meant that businesses, if they desired, could charge a surcharge to customers who paid by credit card. The RBA has now varied its surcharging Standards to allow card scheme rules to limit the surcharge a business sets to ‘the reasonable cost of acceptance’. Currently this is self-regulated, however if enforced by the credit card providers, this could potentially reduce the transactional costs to consumers by millions of dollar per annum. According to RBA data, the average net fee incurred by merchants currently is:

As at Dec 2012, the average merchant fee charged by Credit Card Types:

* MasterCard and Visa 0.84%

* American Express 1.81%

* Diners Club 2.08%

Source: RBA Average merchant fees for debit, credit and charge cards

HOW DO WE USE OUR CREDIT CARDS?

The credit card market overall has remained stable over the twelve months since our last credit card star ratings report, with no significant fluctuation in the number of cards or providers. At a product level, there is a continued push towards removing the “gold” level of credit card, with consumers being transferred to platinum or black cards instead.

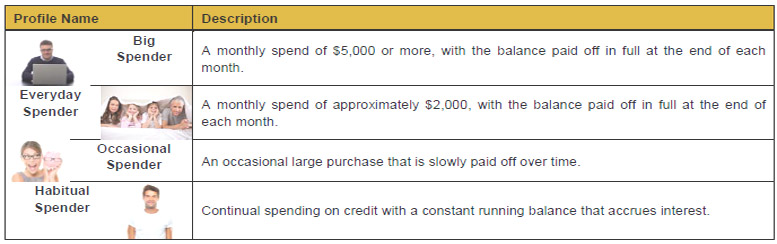

Different credit card users have different spending habits and therefore value different aspects of their credit card. In recognition of these differences, the CANSTAR credit card star ratings methodology reflects a range of spending styles and credit card usage.

Profile Name Description

-

Big Spender A monthly spend of $5,000 or more, with the balance paid off in full at the end of each month.

Everyday Spender A monthly spend of approximately $2,000, with the balance paid off in full at the end of each month.

Occasional Spender An occasional large purchase that is slowly paid off over time.

Habitual Spender Continual spending on credit with a constant running balance that accrues interest.

These four different credit card user profiles broadly cover the majority of card spending and payment patterns in Australia. So what features should each “type” of user look for in a credit card? As a general rule:

Tip: Look for a card that provides features and perks that you use frequently. These may include free travel insurance, concierge service and a rewards program.

Beware: Cards aimed at big spenders have high interest rates, so a few missed payments, combined with a high annual fee, can negate the benefits you receive from the “extras”.

Tip: Look for a card that has a reasonable annual fee, has maximum interest-free days and a rewards program that provides benefits that are relevant to you.

Beware: Of high annual fees. Make sure that your annual spending attracts enough rewards to justify the annual fee.

Tip: Because you may have an ongoing balance for part of the year, try to find low rate card with a low or no annual fee. Look for interest free days but remember that they are null and void as soon as your fail to pay your full balance.

Beware: Steer clear of high-interest rewards cards as the additional costs would likely outweigh the rewards benefits.

Tip: Find a low rate card with a very low or no annual fee. If you can get a suitable card that offers instant rewards or discounts at places you regularly use, that’s even better.

Beware: Don’t be swayed by cards offering big rewards, as these usually come with big monthly interest rates and/or large annual fees.

WHO OFFERS OUTSTANDING VALUE?

There is no shortage of credit cards vying for your business. To help you compare the products available, CANSTAR has looked at 181 credit cards across 67 lenders, assessing the value for each category of spender. We have found:

•

18 credit cards which offer outstanding value for big spenders • 19 credit cards which offer outstanding value for everyday spenders•

12 credit cards which offer outstanding value for occasional spenders•

18 credit cards which offer outstanding value for habitual spendersCANSTAR’s

credit card star ratings is an invaluable starting point when creating a shopping list of credit cards that match your spending profile.Cards rated five stars denote outstanding value.

COPYRIGHT

© CANSTAR Pty Limited ABN 21 053 646 165, 2008. The recipient must not reproduce or transmit to third parties the whole or any part of this work, whether attributed to CANSTAR or not, unless with prior written permission from CANSTAR, which if provided, may be provided on conditions.

Credit Card Star Ratings

Spend to

Waive

Annual Fee

Rate

(as at

26/10/12)

Free

Days

AnnualisedFee

Annual Fee ($)

(as at 26/10/12)

Product

MaximumCredit Limit ($)

Minimum

Rewards

Program

Availabe

We endeavour to include the majority of product providers in the market and to compare the product features most relevant to consumers in our ratings. This is not always possible and it may be that not every product in the market is included in the rating nor every feature compared that is relevant to you

BIG SPENDER

Company

"outstanding value"ANZ Rewards Platinum

19.39% 55 149.00 N/A 6000 No MaxBankwest More Gold MasterCard

19.49% 55 89.00 N/A 5000 50000Bankwest More Platinum MasterCard

19.49% 55 99.00 N/A 8000 100000Bankwest Qantas Platinum MasterCard

19.49% 55 99.00 N/A 8000 No MaxBOQ Platinum Visa

20.74% 55 199.00 N/A 6000 30000Citibank Emirates Platinum MasterCard

20.99% 55 229.00 N/A 5000 100000Citibank Platinum

20.99% 55 199.00 N/A 8000 100000Citibank Select Credit Card

20.74% 55 700.00 N/A 18000 100000Citibank Signature

20.99% 55 395.00 N/A 15000 100000Coles Coles MasterCard

19.99% 62 49.00 N/A 500 No MaxColes Coles Platinum MasterCard

19.99% 62 49.00 N/A 8000 No MaxCommonwealth Bank Diamond Awards

20.24% 55 425.00 N/A 18000 No MaxCommonwealth Bank Gold Awards

20.24% 55 144.00 N/A 4000 No MaxCommonwealth Bank Platinum Awards

20.24% 55 280.00 N/A 8000 No MaxCredit Unions* Platinum MasterCard

20.24% 55 179.00 N/A 6000 30000CUA Platinum MasterCard

20.24% 55 179.00 N/A 6000 30000HSBC Platinum Credit Card

19.99% 55 129.00 N/A 6000 No MaxHSBC Platinum Qantas Credit Card

19.99% 55 199.00 N/A 6000 No Maxnab flybuys Rewards Card

19.49% 44 65.00 N/A 6000 No MaxSuncorp Bank Platinum Card

20.74% 55 199.00 N/A 6000 30000

American Express David Jones Card

20.74% 44 99.00 N/A 2000 25000American Express Platinum Edge Credit Card

20.74% 55 149.00 N/A 3000 50000American Express Qantas Ultimate Card

20.74% 44 450.00 N/A 5000 100000ANZ Freq Flyer Platinum

19.39% 55 295.00 N/A 6000 No MaxANZ Low Rate Platinum

13.14% 55 99.00 N/A 6000 No MaxANZ Platinum

19.39% 55 87.00 20000 6000 No MaxANZ Rewards

19.39% 44 89.00 N/A 1000 No MaxBank of Melbourne Amplify Credit Card

18.74% 55 79.00 N/A 1000 80000BankSA Amplify Credit Card

18.74% 55 79.00 N/A 1000 80000Bankwest Breeze Platinum MasterCard

11.99% 55 99.00 N/A 8000 No MaxBankwest More MasterCard

19.49% 55 49.00 N/A 1000 25000Bankwest Zero Platinum MasterCard

17.99% 55 0.00 N/A 8000 No MaxCitibank Clear Platinum Visa

11.99% 55 99.00 N/A 8000 60000Coastline Credit Union Visa Rewarder

17.00% 55 52.00 12000 1000 25000Commonwealth Bank Standard Awards

20.24% 55 89.00 N/A 500 No MaxCredit Unions* Rewards MasterCard

19.74% 55 90.00 N/A 5000 25000CUA Rewards MasterCard

19.74% 55 90.00 N/A 5000 25000nab Qantas Plus

19.99% 44 146.00 N/A 5000 500000nab Qantas Rewards Premium

19.99% 44 250.00 N/A 6000 500000nab Velocity Rewards Premium

19.99% 44 150.00 N/A 6000 No MaxQantas Staff CU Lifestyle Plus

15.85% 46 0.00 N/A 1000 50000Qantas Staff CU Visa Platinum Credit Card

18.99% 46 195.00 N/A 6000 50000Qld Police Credit Union Bluey Rewarder Card

15.74% 55 48.00 8000 1000 25000Queensland Country CredVisa Card

13.20% 55 39.00 N/A 500 No MaxReport Date: 2/05/2013, (All information is correct as at April 15th, 2013) Credit Card Star Ratings 2013 - page 1

your guide to product excellence

Credit Card Star Ratings

Spend to

Waive

Annual Fee

Rate

(as at

26/10/12)

Free

Days

AnnualisedFee

Report Date: April 2013

Annual Fee ($)

(as at 26/10/12)

Product

MaximumCredit Limit ($)

Minimum

Rewards

Program

Availabe

We endeavour to include the majority of product providers in the market and to compare the product features most relevant to

consumers in our ratings. This is not always possible and it may be that not every product in the market is included in the rating nor

every feature compared that is relevant to you

BIG SPENDER

Company

St.George Bank Amplify Credit Card

18.74% 55 79.00 N/A 1000 80000Suncorp Bank Gold Card

20.50% 55 120.00 N/A 5000 25000Virgin Money Velocity Flyer Credit Card

20.99% 44 129.00 N/A 6000 100000Virgin Money Velocity High Flyer Credit Card

20.99% 44 289.00 N/A 6000 100000Westpac 55 day Platinum Visa

19.59% 55 90.00 20000 6000 100000Westpac Altitude

19.99% 45 100.00 N/A 1000 30000Westpac Altitude Platinum

19.99% 45 150.00 N/A 6000 50000Westpac earth Platinum

19.99% 45 125.00 N/A 8000 50000Westpac Singapore Airlines Platinum Car

19.49% 45 250.00 N/A 8000 100000Woolworths Limited Everyday Money

19.84% 55 49.00 N/A 1000 No MaxWoolworths Limited Everyday Rewards Qantas Cred

19.99% 55 89.00 N/A 8000 No Max

ADCU Low Rate Visa Card

10.99% 55 49.00 N/A 500 No MaxAmerican Express Platinum Reserve Credit Card

20.74% 55 395.00 N/A 3000 50000American Express Qantas Discovery Card

20.74% 44 0.00 N/A 2000 100000American Express Qantas Premium Card

20.74% 44 249.00 N/A 5000 100000American Express Velocity Gold Card

20.74% 44 199.00 N/A 3000 50000American Express Velocity Platinum Card

20.74% 44 349.00 N/A 3000 100000ANZ Balance Visa

14.39% 55 79.00 N/A 1000 15000ANZ First

19.39% 44 30.00 N/A 1000 No MaxANZ Frequent Flyer

19.39% 44 95.00 N/A 1000 No MaxANZ Low Rate

13.14% 55 58.00 N/A 1000 15000Bank of Melbourne Gold Low Rate MasterCard/Visa

15.99% 55 79.00 N/A 4000 80000Bank of Melbourne Platinum Visa Card

15.99% 55 89.00 N/A 6000 80000Bank of Melbourne Vertigo MasterCard

13.24% 55 55.00 N/A 500 40000BankSA Gold Low Rate MasterCard/Visa

15.99% 55 79.00 N/A 4000 80000BankSA Platinum Visa Card

15.99% 55 89.00 N/A 6000 80000BankSA Vertigo MasterCard

13.24% 55 55.00 N/A 500 40000Bankwest Breeze Gold MasterCard

11.99% 55 89.00 N/A 5000 50000Bankwest Breeze MasterCard

11.99% 55 59.00 N/A 1000 25000Bankwest Qantas Classic MasterCard

19.49% 55 49.00 N/A 1000 No MaxBankwest Qantas Gold MasterCard

19.49% 55 89.00 N/A 5000 No MaxBankwest Zero Gold MasterCard

17.99% 55 0.00 N/A 5000 No MaxBankwest Zero MasterCard

17.99% 55 0.00 N/A 1000 25000bcu Visa Bonus Rewarder

16.80% 55 40.00 N/A 500 No MaxBendigo Bank Basic Black MasterCard/Visa

12.49% 44 45.00 N/A 500 50000Bendigo Bank Ready Red MasterCard/Visa

19.99% 44 45.00 N/A 500 50000Bendigo Bank RSPCA Rescue Rewards

19.64% 55 60.00 N/A 500 50000Commonwealth Bank Low Fee Gold MasterCard

19.74% 55 90.00 10000 4000 No MaxCommonwealth Bank Low Fee MasterCard

19.74% 55 24.00 1000 500 No MaxCommonwealth Bank Low Rate Gold MasterCard

12.99% 55 120.00 N/A 4000 No MaxCommonwealth Bank Low Rate MasterCard

12.99% 55 78.00 N/A 500 No MaxCommunity First CU Low Rate Visa Cred Card

9.50% 55 40.00 N/A 1000 15000Community First CU McGrath Pink Visa Card

9.50% 55 40.00 N/A 1000 15000Credit Union SA Visa Credit Card

10.49% 55 10.00 N/A 1000 20000Report Date: 2/05/2013, (All information is correct as at April 15th, 2013) Credit Card Star Ratings 2013 - page 2

your guide to product excellence

Credit Card Star Ratings

Spend to

Waive

Annual Fee

Rate

(as at

26/10/12)

Free

Days

AnnualisedFee

Report Date: April 2013

Annual Fee ($)

(as at 26/10/12)

Product

MaximumCredit Limit ($)

Minimum

Rewards

Program

Availabe

We endeavour to include the majority of product providers in the market and to compare the product features most relevant to

consumers in our ratings. This is not always possible and it may be that not every product in the market is included in the rating nor

every feature compared that is relevant to you

BIG SPENDER

Company

Credit Unions* Low Rate MasterCard

12.99% 55 75.00 N/A 2000 15000CUA Low Rate MasterCard

12.99% 55 75.00 N/A 2000 15000First Option Credit Union Cash Rewards Visa Credit Card

15.99% 45 36.00 N/A 500 20000GE Money 28 Degrees MasterCard

20.99% 55 0.00 N/A 500 No MaxGE Money GO MasterCard

21.74% 62 59.00 N/A 1000 25000Greater Building Society Credit Card

10.25% 55 40.00 10000 1000 25000Horizon Credit Union Visa Credit Card

12.95% 45 0.00 N/A 1000 30000HSBC Classic Credit Card

20.50% 55 59.00 N/A 1000 No MaxHume Building Society Gold

17.95% 55 60.00 12000 7500 50000Hume Building Society Loyalty

17.95% 55 30.00 8000 500 20000Hume Building Society Value

13.15% 55 0.00 N/A 500 20000Hunter United Credit Un Visa Credit Card

11.49% 55 59.00 N/A 1000 20000Intech Credit Union Titanium Visa 55

12.30% 55 46.00 N/A 1000 30000Jetstar MasterCard

13.99% 55 59.00 N/A 2000 50000Jetstar Platinum MasterCard

19.99% 55 149.00 N/A 8000 100000Macquarie Bank Hilton Platinum Card

20.95% 55 295.00 N/A 6000 No MaxMacquarie Bank Visa Platinum Card

20.95% 55 200.00 N/A 6000 No MaxMacquarie Credit Union Visa Credit Card

13.54% 55 15.00 N/A 1000 10000nab Gold MasterCard/Visa

19.49% 44 90.00 N/A 6000 No Maxnab Low Fee MasterCard

19.49% 44 30.00 N/A 500 No Maxnab Low Rate Card

13.99% 55 59.00 N/A 500 No Maxnab Qantas Rewards

19.99% 44 65.00 N/A 500 500000nab Velocity Rewards

19.99% 44 65.00 N/A 500 No MaxNewcastle Permanent Value+ Credit Card

12.24% 55 49.00 N/A 500 20000People's Choice Credit UnCharity Credit Card

15.95% 62 40.00 N/A 1000 No MaxPeople's Choice Credit UnVisa Credit Card

15.95% 62 40.00 N/A 1000 No MaxPolice Credit Visa Credit Gold

16.95% 55 50.00 N/A 5000 30000Police Credit Visa Credit Silver

11.95% 44 0.00 N/A 1000 10000Qantas Staff CU Lifestyle

12.49% 0 0.00 N/A 1000 50000Qld Police Credit Union Bluey Card

12.74% 55 25.00 8000 1000 25000Select Credit Union Super Credit Card

10.99% 55 30.00 N/A 1000 20000SGE Credit Union Classic Solutions

12.95% 45 50.00 N/A 1000 10000SGE Credit Union Gold Solutions

14.95% 55 100.00 N/A 5000 20000St.George Bank Gold Low Rate MasterCard/Visa

15.99% 55 79.00 N/A 4000 80000St.George Bank Platinum Visa Card

15.99% 55 89.00 N/A 6000 80000St.George Bank Vertigo MasterCard

13.24% 55 55.00 N/A 500 40000Teachers Mutual Bank Teachers Credit Card

11.50% 55 0.00 N/A 1000 25000Victoria Teachers Mutual Visa Classic Credit Card

13.19% 55 0.00 N/A 500 No MaxVictoria Teachers Mutual Visa Platinum Credit Card

9.99% 55 84.00 N/A 6000 No MaxWestpac 55 day MasterCard/Visa

19.59% 55 30.00 10000 1000 30000Westpac earth

19.99% 45 75.00 N/A 1000 No MaxWestpac Low Rate MasterCard/Visa

13.49% 55 45.00 N/A 1000 30000

bankmecu Visa Credit Card

13.39% 55 0.00 N/A 1000 No Maxbcu Classic Visa Card

11.80% 55 40.00 N/A 500 No MaxReport Date: 2/05/2013, (All information is correct as at April 15th, 2013) Credit Card Star Ratings 2013 - page 3

your guide to product excellence

Credit Card Star Ratings

Spend to

Waive

Annual Fee

Rate

(as at

26/10/12)

Free

Days

AnnualisedFee

Report Date: April 2013

Annual Fee ($)

(as at 26/10/12)

Product

MaximumCredit Limit ($)

Minimum

Rewards

Program

Availabe

We endeavour to include the majority of product providers in the market and to compare the product features most relevant to

consumers in our ratings. This is not always possible and it may be that not every product in the market is included in the rating nor

every feature compared that is relevant to you

BIG SPENDER

Company

Bendigo Bank Gold Visa

19.99% 55 85.00 N/A 10000 50000Bendigo Bank RSPCA Rescue Visa

15.49% 40 24.00 N/A 500 50000BOQ Low Rate Visa Card

13.49% 55 55.00 N/A 2000 20000Defence Bank True Blue Credit Card

11.74% 55 45.00 N/A 1000 25000ECU Australia Low Rate Visa Credit Card

13.50% 55 48.00 N/A 1000 50000First Option Credit Union Standard Visa Credit Card

13.49% 45 18.00 N/A 500 20000GE Money eco MasterCard

20.49% 55 49.00 N/A 500 20000GE Money Gem Visa

22.99% 55 99.00 N/A 1000 No MaxGE Money Low Rate MasterCard

15.49% 55 58.00 N/A 500 No MaxHeritage Bank Visa Classic Basic

16.75% 55 18.00 10000 1000 10000Heritage Bank Visa Classic No Frills

11.80% 0 0.00 N/A 1000 10000Heritage Bank Visa Classic Rewards

16.75% 55 48.00 N/A 1000 10000Heritage Bank Visa Gold Basic

16.75% 55 36.00 20000 5000 50000Heritage Bank Visa Gold No Frills

11.80% 0 0.00 N/A 5000 50000HSBC Credit Card

17.99% 55 0.00 N/A 1000 No MaxMacquarie Bank Visa Gold Card

20.95% 55 130.00 N/A 2000 50000Macquarie Bank Visa RateSaver Card

14.95% 55 69.00 N/A 2000 50000ME Bank MasterCard

12.25% 44 49.00 7500 1000 15000Myer Myer Visa Card

20.69% 62 69.00 N/A 1000 No MaxP&N Bank Easypay Visa

11.99% 45 40.00 N/A 500 No MaxSCU Low Rate Visa Credit Card

10.49% 55 30.00 N/A 1000 No MaxSuncorp Bank Standard Card

12.74% 0 55.00 N/A 2000 20000Virgin Money No Annual Fee Credit Card

18.99% 44 0.00 N/A 2000 10000

Bank of Melbourne No Annual Fee MasterCard/Visa

20.49% 0 0.00 N/A 500 40000bankmecu Low Rate Visa CreditCard

10.39% 0 59.00 N/A 1000 No MaxBankSA No Annual Fee MasterCard/Visa

20.49% 0 0.00 N/A 500 40000Coastline Credit Union Visa Credit Card

17.50% 0 0.00 N/A 500 No MaxHeritage Bank Visa Gold Rewards

16.75% 55 90.00 N/A 5000 50000SERVICE ONE Members BVisa

15.25% 0 0.00 N/A 500 10000St.George Bank No Annual Fee MasterCard/Visa

20.49% 0 0.00 N/A 500 40000*Credit Unions includes the following financial institutions: Catalyst Mutual

Community CPS Australia

Companion CU

FCCS Credit Union

Holiday Coast CU

Illawarra CU NSW

IMB

MyState Financial

QT Mutual Bank

Queenslanders CU

SERVICE ONE Members Bank

Sutherland Credit Union

Unicredit-WA

Report Date: 2/05/2013, (All information is correct as at April 15th, 2013) Credit Card Star Ratings 2013 - page 4

your guide to product excellence

Credit Card Star Ratings

Spend to

Waive

Annual Fee

Rate

(as at

26/10/12)

Free

Days

AnnualisedFee

Report Date: April 2013

Annual Fee ($)

(as at 26/10/12)

Product

MaximumCredit Limit ($)

Minimum

Rewards

Program

Availabe

We endeavour to include the majority of product providers in the market and to compare the product features most relevant to

consumers in our ratings. This is not always possible and it may be that not every product in the market is included in the rating nor

every feature compared that is relevant to you

EVERYDAY SPENDER

Company

"outstanding value"ANZ Rewards Platinum

19.39% 55 149.00 N/A 6000 No MaxBankwest More Gold MasterCard

19.49% 55 89.00 N/A 5000 50000Bankwest More Platinum MasterCard

19.49% 55 99.00 N/A 8000 100000Bankwest Qantas Platinum MasterCard

19.49% 55 99.00 N/A 8000 No MaxCitibank Platinum

20.99% 55 199.00 N/A 8000 100000Coastline Credit Union Visa Rewarder

17.00% 55 52.00 12000 1000 25000Coles Coles MasterCard

19.99% 62 49.00 N/A 500 No MaxColes Coles Platinum MasterCard

19.99% 62 49.00 N/A 8000 No MaxCommonwealth Bank Standard Awards

20.24% 55 89.00 N/A 500 No MaxCredit Unions* Platinum MasterCard

20.24% 55 179.00 N/A 6000 30000Credit Unions* Rewards MasterCard

19.74% 55 90.00 N/A 5000 25000CUA Rewards MasterCard

19.74% 55 90.00 N/A 5000 25000Hume Building Society Gold

17.95% 55 60.00 12000 7500 50000Hume Building Society Loyalty

17.95% 55 30.00 8000 500 20000Jetstar Platinum MasterCard

19.99% 55 149.00 N/A 8000 100000nab flybuys Rewards Card

19.49% 44 65.00 N/A 6000 No MaxQantas Staff CU Lifestyle

12.49% 0 0.00 N/A 1000 50000Qantas Staff CU Lifestyle Plus

15.85% 46 0.00 N/A 1000 50000Qld Police Credit Union Bluey Rewarder Card

15.74% 55 48.00 8000 1000 25000Teachers Mutual Bank Teachers Credit Card

11.50% 55 0.00 N/A 1000 25000

American Express David Jones Card

20.74% 44 99.00 N/A 2000 25000American Express Qantas Discovery Card

20.74% 44 0.00 N/A 2000 100000ANZ Platinum

19.39% 55 87.00 20000 6000 No MaxANZ Rewards

19.39% 44 89.00 N/A 1000 No MaxBank of Melbourne Amplify Credit Card

18.74% 55 79.00 N/A 1000 80000BankSA Amplify Credit Card

18.74% 55 79.00 N/A 1000 80000Bankwest More MasterCard

19.49% 55 49.00 N/A 1000 25000Bankwest Zero Platinum MasterCard

17.99% 55 0.00 N/A 8000 No Maxbcu Visa Bonus Rewarder

16.80% 55 40.00 N/A 500 No MaxCitibank Clear Platinum Visa

11.99% 55 99.00 N/A 8000 60000Commonwealth Bank Low Fee Gold MasterCard

19.74% 55 90.00 10000 4000 No MaxCUA Platinum MasterCard

20.24% 55 179.00 N/A 6000 30000First Option Credit Union Cash Rewards Visa Credit Card

15.99% 45 36.00 N/A 500 20000Greater Building Society Credit Card

10.25% 55 40.00 10000 1000 25000Horizon Credit Union Visa Credit Card

12.95% 45 0.00 N/A 1000 30000HSBC Platinum Qantas Credit Card

19.99% 55 199.00 N/A 6000 No MaxJetstar MasterCard

13.99% 55 59.00 N/A 2000 50000Myer Myer Visa Card

20.69% 62 69.00 N/A 1000 No Maxnab Qantas Plus

19.99% 44 146.00 N/A 5000 500000nab Qantas Rewards

19.99% 44 65.00 N/A 500 500000nab Velocity Rewards

19.99% 44 65.00 N/A 500 No Maxnab Velocity Rewards Premium

19.99% 44 150.00 N/A 6000 No MaxPolice Credit Visa Credit Silver

11.95% 44 0.00 N/A 1000 10000Qld Police Credit Union Bluey Card

12.74% 55 25.00 8000 1000 25000Report Date: 2/05/2013, (All information is correct as at April 15th, 2013) Credit Card Star Ratings 2013 - page 5

your guide to product excellence

Credit Card Star Ratings

Spend to

Waive

Annual Fee

Rate

(as at

26/10/12)

Free

Days

AnnualisedFee

Report Date: April 2013

Annual Fee ($)

(as at 26/10/12)

Product

MaximumCredit Limit ($)

Minimum

Rewards

Program

Availabe

We endeavour to include the majority of product providers in the market and to compare the product features most relevant to

consumers in our ratings. This is not always possible and it may be that not every product in the market is included in the rating nor

every feature compared that is relevant to you

EVERYDAY SPENDER

Company

Queensland Country CredVisa Card

13.20% 55 39.00 N/A 500 No MaxSt.George Bank Amplify Credit Card

18.74% 55 79.00 N/A 1000 80000Suncorp Bank Gold Card

20.50% 55 120.00 N/A 5000 25000Virgin Money Velocity Flyer Credit Card

20.99% 44 129.00 N/A 6000 100000Virgin Money Velocity High Flyer Credit Card

20.99% 44 289.00 N/A 6000 100000Westpac 55 day Platinum Visa

19.59% 55 90.00 20000 6000 100000Westpac Altitude

19.99% 45 100.00 N/A 1000 30000Westpac Altitude Platinum

19.99% 45 150.00 N/A 6000 50000Westpac earth Platinum

19.99% 45 125.00 N/A 8000 50000Westpac Singapore Airlines Platinum Car

19.49% 45 250.00 N/A 8000 100000Woolworths Limited Everyday Money

19.84% 55 49.00 N/A 1000 No MaxWoolworths Limited Everyday Rewards Qantas Cred

19.99% 55 89.00 N/A 8000 No Max

ADCU Low Rate Visa Card

10.99% 55 49.00 N/A 500 No MaxAmerican Express Platinum Edge Credit Card

20.74% 55 149.00 N/A 3000 50000American Express Platinum Reserve Credit Card

20.74% 55 395.00 N/A 3000 50000American Express Velocity Gold Card

20.74% 44 199.00 N/A 3000 50000American Express Velocity Platinum Card

20.74% 44 349.00 N/A 3000 100000ANZ Balance Visa

14.39% 55 79.00 N/A 1000 15000ANZ First

19.39% 44 30.00 N/A 1000 No MaxANZ Freq Flyer Platinum

19.39% 55 295.00 N/A 6000 No MaxANZ Frequent Flyer

19.39% 44 95.00 N/A 1000 No MaxANZ Low Rate

13.14% 55 58.00 N/A 1000 15000ANZ Low Rate Platinum

13.14% 55 99.00 N/A 6000 No MaxBank of Melbourne Gold Low Rate MasterCard/Visa

15.99% 55 79.00 N/A 4000 80000Bank of Melbourne Platinum Visa Card

15.99% 55 89.00 N/A 6000 80000Bank of Melbourne Vertigo MasterCard

13.24% 55 55.00 N/A 500 40000bankmecu Visa Credit Card

13.39% 55 0.00 N/A 1000 No MaxBankSA Gold Low Rate MasterCard/Visa

15.99% 55 79.00 N/A 4000 80000BankSA Platinum Visa Card

15.99% 55 89.00 N/A 6000 80000BankSA Vertigo MasterCard

13.24% 55 55.00 N/A 500 40000Bankwest Breeze Gold MasterCard

11.99% 55 89.00 N/A 5000 50000Bankwest Breeze MasterCard

11.99% 55 59.00 N/A 1000 25000Bankwest Breeze Platinum MasterCard

11.99% 55 99.00 N/A 8000 No MaxBankwest Qantas Classic MasterCard

19.49% 55 49.00 N/A 1000 No MaxBankwest Qantas Gold MasterCard

19.49% 55 89.00 N/A 5000 No MaxBankwest Zero Gold MasterCard

17.99% 55 0.00 N/A 5000 No MaxBankwest Zero MasterCard

17.99% 55 0.00 N/A 1000 25000Bendigo Bank Basic Black MasterCard/Visa

12.49% 44 45.00 N/A 500 50000Bendigo Bank Ready Red MasterCard/Visa

19.99% 44 45.00 N/A 500 50000Bendigo Bank RSPCA Rescue Rewards

19.64% 55 60.00 N/A 500 50000Bendigo Bank RSPCA Rescue Visa

15.49% 40 24.00 N/A 500 50000BOQ Blue Visa

20.74% 44 60.00 N/A 2000 7500BOQ Platinum Visa

20.74% 55 199.00 N/A 6000 30000Citibank Emirates Platinum MasterCard

20.99% 55 229.00 N/A 5000 100000Report Date: 2/05/2013, (All information is correct as at April 15th, 2013) Credit Card Star Ratings 2013 - page 6

your guide to product excellence

Credit Card Star Ratings

Spend to

Waive

Annual Fee

Rate

(as at

26/10/12)

Free

Days

AnnualisedFee

Report Date: April 2013

Annual Fee ($)

(as at 26/10/12)

Product

MaximumCredit Limit ($)

Minimum

Rewards

Program

Availabe

We endeavour to include the majority of product providers in the market and to compare the product features most relevant to

consumers in our ratings. This is not always possible and it may be that not every product in the market is included in the rating nor

every feature compared that is relevant to you

EVERYDAY SPENDER

Company

Citibank Select Credit Card

20.74% 55 700.00 N/A 18000 100000Citibank Signature

20.99% 55 395.00 N/A 15000 100000Commonwealth Bank Diamond Awards

20.24% 55 425.00 N/A 18000 No MaxCommonwealth Bank Gold Awards

20.24% 55 144.00 N/A 4000 No MaxCommonwealth Bank Low Fee MasterCard

19.74% 55 24.00 1000 500 No MaxCommonwealth Bank Low Rate Gold MasterCard

12.99% 55 120.00 N/A 4000 No MaxCommonwealth Bank Low Rate MasterCard

12.99% 55 78.00 N/A 500 No MaxCommonwealth Bank Platinum Awards

20.24% 55 280.00 N/A 8000 No MaxCommunity First CU Low Rate Visa Cred Card

9.50% 55 40.00 N/A 1000 15000Community First CU McGrath Pink Visa Card

9.50% 55 40.00 N/A 1000 15000Credit Union SA Visa Credit Card

10.49% 55 10.00 N/A 1000 20000Credit Unions* Low Rate MasterCard

12.99% 55 75.00 N/A 2000 15000CUA Low Rate MasterCard

12.99% 55 75.00 N/A 2000 15000First Option Credit Union Standard Visa Credit Card

13.49% 45 18.00 N/A 500 20000GE Money 28 Degrees MasterCard

20.99% 55 0.00 N/A 500 No MaxGE Money GO MasterCard

21.74% 62 59.00 N/A 1000 25000Heritage Bank Visa Classic Basic

16.75% 55 18.00 10000 1000 10000Heritage Bank Visa Classic No Frills

11.80% 0 0.00 N/A 1000 10000Heritage Bank Visa Gold Basic

16.75% 55 36.00 20000 5000 50000Heritage Bank Visa Gold No Frills

11.80% 0 0.00 N/A 5000 50000HSBC Classic Credit Card

20.50% 55 59.00 N/A 1000 No MaxHSBC Credit Card

17.99% 55 0.00 N/A 1000 No MaxHSBC Platinum Credit Card

19.99% 55 129.00 N/A 6000 No MaxHume Building Society Value

13.15% 55 0.00 N/A 500 20000Hunter United Credit Un Visa Credit Card

11.49% 55 59.00 N/A 1000 20000Intech Credit Union Titanium Visa 55

12.30% 55 46.00 N/A 1000 30000Macquarie Credit Union Visa Credit Card

13.54% 55 15.00 N/A 1000 10000ME Bank MasterCard

12.25% 44 49.00 7500 1000 15000nab Gold MasterCard/Visa

19.49% 44 90.00 N/A 6000 No Maxnab Low Fee MasterCard

19.49% 44 30.00 N/A 500 No Maxnab Low Rate Card

13.99% 55 59.00 N/A 500 No Maxnab Qantas Rewards Premium

19.99% 44 250.00 N/A 6000 500000Newcastle Permanent Value+ Credit Card

12.24% 55 49.00 N/A 500 20000People's Choice Credit UnCharity Credit Card

15.95% 62 40.00 N/A 1000 No MaxPeople's Choice Credit UnVisa Credit Card

15.95% 62 40.00 N/A 1000 No MaxPolice Credit Visa Credit Gold

16.95% 55 50.00 N/A 5000 30000Qantas Staff CU Visa Platinum Credit Card

18.99% 46 195.00 N/A 6000 50000Select Credit Union Super Credit Card

10.99% 55 30.00 N/A 1000 20000SGE Credit Union Gold Solutions

14.95% 55 100.00 N/A 5000 20000St.George Bank Gold Low Rate MasterCard/Visa

15.99% 55 79.00 N/A 4000 80000St.George Bank Platinum Visa Card

15.99% 55 89.00 N/A 6000 80000St.George Bank Vertigo MasterCard

13.24% 55 55.00 N/A 500 40000Suncorp Bank Platinum Card

20.74% 55 199.00 N/A 6000 30000Victoria Teachers Mutual Visa Classic Credit Card

13.19% 55 0.00 N/A 500 No MaxVictoria Teachers Mutual Visa Platinum Credit Card

9.99% 55 84.00 N/A 6000 No MaxWestpac 55 day MasterCard/Visa

19.59% 55 30.00 10000 1000 30000Report Date: 2/05/2013, (All information is correct as at April 15th, 2013) Credit Card Star Ratings 2013 - page 7

your guide to product excellence

Credit Card Star Ratings

Spend to

Waive

Annual Fee

Rate

(as at

26/10/12)

Free

Days

AnnualisedFee

Report Date: April 2013

Annual Fee ($)

(as at 26/10/12)

Product

MaximumCredit Limit ($)

Minimum

Rewards

Program

Availabe

We endeavour to include the majority of product providers in the market and to compare the product features most relevant to

consumers in our ratings. This is not always possible and it may be that not every product in the market is included in the rating nor

every feature compared that is relevant to you

EVERYDAY SPENDER

Company

Westpac earth

19.99% 45 75.00 N/A 1000 No MaxWestpac Low Rate MasterCard/Visa

13.49% 55 45.00 N/A 1000 30000

American Express Qantas Premium Card

20.74% 44 249.00 N/A 5000 100000Bank of Melbourne No Annual Fee MasterCard/Visa

20.49% 0 0.00 N/A 500 40000BankSA No Annual Fee MasterCard/Visa

20.49% 0 0.00 N/A 500 40000bcu Classic Visa Card

11.80% 55 40.00 N/A 500 No MaxBendigo Bank Gold Visa

19.99% 55 85.00 N/A 10000 50000BOQ Low Rate Visa Card

13.49% 55 55.00 N/A 2000 20000Coastline Credit Union Visa Credit Card

17.50% 0 0.00 N/A 500 No MaxDefence Bank True Blue Credit Card

11.74% 55 45.00 N/A 1000 25000ECU Australia Low Rate Visa Credit Card

13.50% 55 48.00 N/A 1000 50000Encompass Credit Union Visa Credit Card

15.00% 55 36.00 N/A 1000 5000GE Money Gem Visa

22.99% 55 99.00 N/A 1000 No MaxGE Money Low Rate MasterCard

15.49% 55 58.00 N/A 500 No MaxMacquarie Bank Hilton Platinum Card

20.95% 55 295.00 N/A 6000 No MaxMacquarie Bank Visa Platinum Card

20.95% 55 200.00 N/A 6000 No MaxP&N Bank Easypay Visa

11.99% 45 40.00 N/A 500 No MaxSCU Low Rate Visa Credit Card

10.49% 55 30.00 N/A 1000 No MaxSGE Credit Union Classic Solutions

12.95% 45 50.00 N/A 1000 10000St.George Bank No Annual Fee MasterCard/Visa

20.49% 0 0.00 N/A 500 40000Virgin Money No Annual Fee Credit Card

18.99% 44 0.00 N/A 2000 10000

American Express Qantas Ultimate Card

20.74% 44 450.00 N/A 5000 100000bankmecu Low Rate Visa CreditCard

10.39% 0 59.00 N/A 1000 No MaxGE Money eco MasterCard

20.49% 55 49.00 N/A 500 20000Heritage Bank Visa Classic Rewards

16.75% 55 48.00 N/A 1000 10000Heritage Bank Visa Gold Rewards

16.75% 55 90.00 N/A 5000 50000Macquarie Bank Visa Gold Card

20.95% 55 130.00 N/A 2000 50000Macquarie Bank Visa RateSaver Card

14.95% 55 69.00 N/A 2000 50000SERVICE ONE Members BVisa

15.25% 0 0.00 N/A 500 10000Suncorp Bank Standard Card

12.74% 0 55.00 N/A 2000 20000*Credit Unions includes the following financial institutions: Catalyst Mutual

Community CPS Australia

Companion CU

FCCS Credit Union

Holiday Coast CU

Illawarra CU NSW

IMB

MyState Financial

QT Mutual Bank

Queenslanders CU

SERVICE ONE Members Bank

Sutherland Credit Union

Unicredit-WA

Report Date: 2/05/2013, (All information is correct as at April 15th, 2013) Credit Card Star Ratings 2013 - page 8

your guide to product excellence

Credit Card Star Ratings

Spend to

Waive

Annual Fee

Rate

(as at

26/10/12)

Free

Days

AnnualisedFee

Report Date: April 2013

Annual Fee ($)

(as at 26/10/12)

Product

MaximumCredit Limit ($)

Minimum

Rewards

Program

Availabe

We endeavour to include the majority of product providers in the market and to compare the product features most relevant to

consumers in our ratings. This is not always possible and it may be that not every product in the market is included in the rating nor

every feature compared that is relevant to you

HABITUAL SPENDER

Company

"outstanding value"ADCU Low Rate Visa Card

10.99% 55 49.00 N/A 500 No Maxbankmecu Low Rate Visa CreditCard

10.39% 0 59.00 N/A 1000 No MaxBankwest Breeze Gold MasterCard

11.99% 55 89.00 N/A 5000 50000Bankwest Breeze MasterCard

11.99% 55 59.00 N/A 1000 25000Community First CU Low Rate Visa Cred Card

9.50% 55 40.00 N/A 1000 15000Community First CU McGrath Pink Visa Card

9.50% 55 40.00 N/A 1000 15000Credit Union SA Visa Credit Card

10.49% 55 10.00 N/A 1000 20000Defence Bank True Blue Credit Card

11.74% 55 45.00 N/A 1000 25000Greater Building Society Credit Card

10.25% 55 40.00 10000 1000 25000Horizon Credit Union Visa Credit Card

12.95% 45 0.00 N/A 1000 30000Hunter United Credit Un Visa Credit Card

11.49% 55 59.00 N/A 1000 20000Intech Credit Union Titanium Visa 55

12.30% 55 46.00 N/A 1000 30000Police Credit Visa Credit Silver

11.95% 44 0.00 N/A 1000 10000Qld Police Credit Union Bluey Card

12.74% 55 25.00 8000 1000 25000SCU Low Rate Visa Credit Card

10.49% 55 30.00 N/A 1000 No MaxSelect Credit Union Super Credit Card

10.99% 55 30.00 N/A 1000 20000Teachers Mutual Bank Teachers Credit Card

11.50% 55 0.00 N/A 1000 25000Victoria Teachers Mutual Visa Platinum Credit Card

9.99% 55 84.00 N/A 6000 No Max

ANZ Low Rate

13.14% 55 58.00 N/A 1000 15000ANZ Low Rate Platinum

13.14% 55 99.00 N/A 6000 No MaxBank of Melbourne Vertigo MasterCard

13.24% 55 55.00 N/A 500 40000bankmecu Visa Credit Card

13.39% 55 0.00 N/A 1000 No MaxBankSA Vertigo MasterCard

13.24% 55 55.00 N/A 500 40000bcu Classic Visa Card

11.80% 55 40.00 N/A 500 No MaxBendigo Bank Basic Black MasterCard/Visa

12.49% 44 45.00 N/A 500 50000BOQ Low Rate Visa Card

13.49% 55 55.00 N/A 2000 20000Commonwealth Bank Low Rate Gold MasterCard

12.99% 55 120.00 N/A 4000 No MaxCommonwealth Bank Low Rate MasterCard

12.99% 55 78.00 N/A 500 No MaxCredit Unions* Low Rate MasterCard

12.99% 55 75.00 N/A 2000 15000CUA Low Rate MasterCard

12.99% 55 75.00 N/A 2000 15000First Option Credit Union Standard Visa Credit Card

13.49% 45 18.00 N/A 500 20000Heritage Bank Visa Classic No Frills

11.80% 0 0.00 N/A 1000 10000Heritage Bank Visa Gold No Frills

11.80% 0 0.00 N/A 5000 50000Hume Building Society Value

13.15% 55 0.00 N/A 500 20000Macquarie Credit Union Visa Credit Card

13.54% 55 15.00 N/A 1000 10000ME Bank MasterCard

12.25% 44 49.00 7500 1000 15000nab Low Rate Card

13.99% 55 59.00 N/A 500 No MaxNewcastle Permanent Value+ Credit Card

12.24% 55 49.00 N/A 500 20000P&N Bank Easypay Visa

11.99% 45 40.00 N/A 500 No MaxQantas Staff CU Lifestyle

12.49% 0 0.00 N/A 1000 50000Queensland Country CredVisa Card

13.20% 55 39.00 N/A 500 No MaxSGE Credit Union Classic Solutions

12.95% 45 50.00 N/A 1000 10000St.George Bank Vertigo MasterCard

13.24% 55 55.00 N/A 500 40000Suncorp Bank Standard Card

12.74% 0 55.00 N/A 2000 20000Report Date: 2/05/2013, (All information is correct as at April 15th, 2013) Credit Card Star Ratings 2013 - page 9

your guide to product excellence

Credit Card Star Ratings

Spend to

Waive

Annual Fee

Rate

(as at

26/10/12)

Free

Days

AnnualisedFee

Report Date: April 2013

Annual Fee ($)

(as at 26/10/12)

Product

MaximumCredit Limit ($)

Minimum

Rewards

Program

Availabe

We endeavour to include the majority of product providers in the market and to compare the product features most relevant to

consumers in our ratings. This is not always possible and it may be that not every product in the market is included in the rating nor

every feature compared that is relevant to you

HABITUAL SPENDER

Company

Victoria Teachers Mutual Visa Classic Credit Card

13.19% 55 0.00 N/A 500 No MaxWestpac Low Rate MasterCard/Visa

13.49% 55 45.00 N/A 1000 30000

ANZ Balance Visa

14.39% 55 79.00 N/A 1000 15000ANZ First

19.39% 44 30.00 N/A 1000 No MaxANZ Frequent Flyer

19.39% 44 95.00 N/A 1000 No MaxANZ Platinum

19.39% 55 87.00 20000 6000 No MaxANZ Rewards

19.39% 44 89.00 N/A 1000 No MaxANZ Rewards Platinum

19.39% 55 149.00 N/A 6000 No MaxBank of Melbourne Amplify Credit Card

18.74% 55 79.00 N/A 1000 80000Bank of Melbourne Gold Low Rate MasterCard/Visa

15.99% 55 79.00 N/A 4000 80000Bank of Melbourne No Annual Fee MasterCard/Visa

20.49% 0 0.00 N/A 500 40000Bank of Melbourne Platinum Visa Card

15.99% 55 89.00 N/A 6000 80000BankSA Amplify Credit Card

18.74% 55 79.00 N/A 1000 80000BankSA Gold Low Rate MasterCard/Visa

15.99% 55 79.00 N/A 4000 80000BankSA No Annual Fee MasterCard/Visa

20.49% 0 0.00 N/A 500 40000BankSA Platinum Visa Card

15.99% 55 89.00 N/A 6000 80000Bankwest More Gold MasterCard

19.49% 55 89.00 N/A 5000 50000Bankwest More MasterCard

19.49% 55 49.00 N/A 1000 25000Bankwest Qantas Classic MasterCard

19.49% 55 49.00 N/A 1000 No MaxBankwest Qantas Gold MasterCard

19.49% 55 89.00 N/A 5000 No MaxBankwest Zero Gold MasterCard

17.99% 55 0.00 N/A 5000 No MaxBankwest Zero MasterCard

17.99% 55 0.00 N/A 1000 25000bcu Visa Bonus Rewarder

16.80% 55 40.00 N/A 500 No MaxBendigo Bank Ready Red MasterCard/Visa

19.99% 44 45.00 N/A 500 50000Bendigo Bank RSPCA Rescue Rewards

19.64% 55 60.00 N/A 500 50000Bendigo Bank RSPCA Rescue Visa

15.49% 40 24.00 N/A 500 50000Coastline Credit Union Visa Credit Card

17.50% 0 0.00 N/A 500 No MaxCoastline Credit Union Visa Rewarder

17.00% 55 52.00 12000 1000 25000Commonwealth Bank Gold Awards

20.24% 55 144.00 N/A 4000 No MaxCommonwealth Bank Low Fee Gold MasterCard

19.74% 55 90.00 10000 4000 No MaxCommonwealth Bank Low Fee MasterCard

19.74% 55 24.00 1000 500 No MaxCommonwealth Bank Standard Awards

20.24% 55 89.00 N/A 500 No MaxCredit Unions* Rewards MasterCard

19.74% 55 90.00 N/A 5000 25000CUA Rewards MasterCard

19.74% 55 90.00 N/A 5000 25000ECU Australia Low Rate Visa Credit Card

13.50% 55 48.00 N/A 1000 50000First Option Credit Union Cash Rewards Visa Credit Card

15.99% 45 36.00 N/A 500 20000GE Money 28 Degrees MasterCard

20.99% 55 0.00 N/A 500 No MaxGE Money Low Rate MasterCard

15.49% 55 58.00 N/A 500 No MaxHeritage Bank Visa Classic Basic

16.75% 55 18.00 10000 1000 10000Heritage Bank Visa Classic Rewards

16.75% 55 48.00 N/A 1000 10000Heritage Bank Visa Gold Basic

16.75% 55 36.00 20000 5000 50000Heritage Bank Visa Gold Rewards

16.75% 55 90.00 N/A 5000 50000HSBC Credit Card

17.99% 55 0.00 N/A 1000 No MaxHSBC Platinum Credit Card

19.99% 55 129.00 N/A 6000 No MaxReport Date: 2/05/2013, (All information is correct as at April 15th, 2013) Credit Card Star Ratings 2013 - page 10

your guide to product excellence

Credit Card Star Ratings

Spend to

Waive

Annual Fee

Rate

(as at

26/10/12)

Free

Days

AnnualisedFee

Report Date: April 2013

Annual Fee ($)

(as at 26/10/12)

Product

MaximumCredit Limit ($)

Minimum

Rewards

Program

Availabe

We endeavour to include the majority of product providers in the market and to compare the product features most relevant to

consumers in our ratings. This is not always possible and it may be that not every product in the market is included in the rating nor

every feature compared that is relevant to you

HABITUAL SPENDER

Company

Hume Building Society Loyalty

17.95% 55 30.00 8000 500 20000Jetstar MasterCard

13.99% 55 59.00 N/A 2000 50000Macquarie Bank Visa RateSaver Card

14.95% 55 69.00 N/A 2000 50000nab flybuys Rewards Card

19.49% 44 65.00 N/A 6000 No Maxnab Gold MasterCard/Visa

19.49% 44 90.00 N/A 6000 No Maxnab Low Fee MasterCard

19.49% 44 30.00 N/A 500 No Maxnab Qantas Plus

19.99% 44 146.00 N/A 5000 500000nab Qantas Rewards

19.99% 44 65.00 N/A 500 500000nab Qantas Rewards Premium

19.99% 44 250.00 N/A 6000 500000nab Velocity Rewards

19.99% 44 65.00 N/A 500 No Maxnab Velocity Rewards Premium

19.99% 44 150.00 N/A 6000 No MaxPeople's Choice Credit UnCharity Credit Card

15.95% 62 40.00 N/A 1000 No MaxPeople's Choice Credit UnVisa Credit Card

15.95% 62 40.00 N/A 1000 No MaxPolice Credit Visa Credit Gold

16.95% 55 50.00 N/A 5000 30000Qantas Staff CU Lifestyle Plus

15.85% 46 0.00 N/A 1000 50000Qantas Staff CU Visa Platinum Credit Card

18.99% 46 195.00 N/A 6000 50000Qld Police Credit Union Bluey Rewarder Card

15.74% 55 48.00 8000 1000 25000SERVICE ONE Members BVisa

15.25% 0 0.00 N/A 500 10000SGE Credit Union Gold Solutions

14.95% 55 100.00 N/A 5000 20000St.George Bank Amplify Credit Card

18.74% 55 79.00 N/A 1000 80000St.George Bank Gold Low Rate MasterCard/Visa

15.99% 55 79.00 N/A 4000 80000St.George Bank No Annual Fee MasterCard/Visa

20.49% 0 0.00 N/A 500 40000St.George Bank Platinum Visa Card

15.99% 55 89.00 N/A 6000 80000Suncorp Bank Gold Card

20.50% 55 120.00 N/A 5000 25000Virgin Money No Annual Fee Credit Card

18.99% 44 0.00 N/A 2000 10000Westpac 55 day MasterCard/Visa

19.59% 55 30.00 10000 1000 30000Westpac 55 day Platinum Visa

19.59% 55 90.00 20000 6000 100000Westpac Altitude

19.99% 45 100.00 N/A 1000 30000Westpac Altitude Platinum

19.99% 45 150.00 N/A 6000 50000Westpac earth

19.99% 45 75.00 N/A 1000 No Max

American Express David Jones Card

20.74% 44 99.00 N/A 2000 25000American Express Qantas Discovery Card

20.74% 44 0.00 N/A 2000 100000ANZ Freq Flyer Platinum

19.39% 55 295.00 N/A 6000 No MaxBOQ Blue Visa

20.74% 44 60.00 N/A 2000 7500Citibank Emirates Platinum MasterCard

20.99% 55 229.00 N/A 5000 100000Coles Coles MasterCard

19.99% 62 49.00 N/A 500 No MaxCredit Unions* Platinum MasterCard

20.24% 55 179.00 N/A 6000 30000CUA Platinum MasterCard

20.24% 55 179.00 N/A 6000 30000GE Money eco MasterCard

20.49% 55 49.00 N/A 500 20000GE Money Gem Visa

22.99% 55 99.00 N/A 1000 No MaxGE Money GO MasterCard

21.74% 62 59.00 N/A 1000 25000HSBC Classic Credit Card

20.50% 55 59.00 N/A 1000 No MaxHSBC Platinum Qantas Credit Card

19.99% 55 199.00 N/A 6000 No MaxMacquarie Bank Hilton Platinum Card

20.95% 55 295.00 N/A 6000 No MaxReport Date: 2/05/2013, (All information is correct as at April 15th, 2013) Credit Card Star Ratings 2013 - page 11

your guide to product excellence

Credit Card Star Ratings

Spend to

Waive

Annual Fee

Rate

(as at

26/10/12)

Free

Days

AnnualisedFee

Report Date: April 2013

Annual Fee ($)

(as at 26/10/12)

Product

MaximumCredit Limit ($)

Minimum

Rewards

Program

Availabe

We endeavour to include the majority of product providers in the market and to compare the product features most relevant to

consumers in our ratings. This is not always possible and it may be that not every product in the market is included in the rating nor

every feature compared that is relevant to you

HABITUAL SPENDER

Company

Macquarie Bank Visa Gold Card

20.95% 55 130.00 N/A 2000 50000Macquarie Bank Visa Platinum Card

20.95% 55 200.00 N/A 6000 No MaxMyer Myer Visa Card

20.69% 62 69.00 N/A 1000 No MaxSuncorp Bank Platinum Card

20.74% 55 199.00 N/A 6000 30000Virgin Money Velocity Flyer Credit Card

20.99% 44 129.00 N/A 6000 100000Woolworths Limited Everyday Money

19.84% 55 49.00 N/A 1000 No Max

American Express Platinum Edge Credit Card

20.74% 55 149.00 N/A 3000 50000American Express Platinum Reserve Credit Card

20.74% 55 395.00 N/A 3000 50000American Express Qantas Premium Card

20.74% 44 249.00 N/A 5000 100000American Express Qantas Ultimate Card

20.74% 44 450.00 N/A 5000 100000American Express Velocity Gold Card

20.74% 44 199.00 N/A 3000 50000American Express Velocity Platinum Card

20.74% 44 349.00 N/A 3000 100000BOQ Platinum Visa

20.74% 55 199.00 N/A 6000 30000Virgin Money Velocity High Flyer Credit Card

20.99% 44 289.00 N/A 6000 100000*Credit Unions includes the following financial institutions: Catalyst Mutual

Community CPS Australia

Companion CU

FCCS Credit Union

Holiday Coast CU

Illawarra CU NSW

IMB

MyState Financial

QT Mutual Bank

Queenslanders CU

SERVICE ONE Members Bank

Sutherland Credit Union

Unicredit-WA

Report Date: 2/05/2013, (All information is correct as at April 15th, 2013) Credit Card Star Ratings 2013 - page 12

your guide to product excellence

Credit Card Star Ratings

Spend to

Waive

Annual Fee

Rate

(as at

26/10/12)

Free

Days

AnnualisedFee

Report Date: April 2013

Annual Fee ($)

(as at 26/10/12)

Product

MaximumCredit Limit ($)

Minimum

Rewards

Program

Availabe

We endeavour to include the majority of product providers in the market and to compare the product features most relevant to

consumers in our ratings. This is not always possible and it may be that not every product in the market is included in the rating nor

every feature compared that is relevant to you

OCCASIONAL SPENDER

Company

"outstanding value"bankmecu Visa Credit Card

13.39% 55 0.00 N/A 1000 No MaxCommunity First CU Low Rate Visa Cred Card

9.50% 55 40.00 N/A 1000 15000Community First CU McGrath Pink Visa Card

9.50% 55 40.00 N/A 1000 15000Credit Union SA Visa Credit Card

10.49% 55 10.00 N/A 1000 20000Heritage Bank Visa Classic No Frills

11.80% 0 0.00 N/A 1000 10000Horizon Credit Union Visa Credit Card

12.95% 45 0.00 N/A 1000 30000Hume Building Society Value

13.15% 55 0.00 N/A 500 20000Macquarie Credit Union Visa Credit Card

13.54% 55 15.00 N/A 1000 10000Police Credit Visa Credit Silver

11.95% 44 0.00 N/A 1000 10000Qantas Staff CU Lifestyle

12.49% 0 0.00 N/A 1000 50000Teachers Mutual Bank Teachers Credit Card

11.50% 55 0.00 N/A 1000 25000Victoria Teachers Mutual Visa Classic Credit Card

13.19% 55 0.00 N/A 500 No Max

ADCU Low Rate Visa Card

10.99% 55 49.00 N/A 500 No MaxANZ Low Rate

13.14% 55 58.00 N/A 1000 15000Bankwest Breeze MasterCard

11.99% 55 59.00 N/A 1000 25000Bankwest Zero MasterCard

17.99% 55 0.00 N/A 1000 25000Bendigo Bank Basic Black MasterCard/Visa

12.49% 44 45.00 N/A 500 50000Bendigo Bank RSPCA Rescue Visa

15.49% 40 24.00 N/A 500 50000Commonwealth Bank Low Fee MasterCard

19.74% 55 24.00 1000 500 No MaxCommonwealth Bank Low Rate MasterCard

12.99% 55 78.00 N/A 500 No MaxDefence Bank True Blue Credit Card

11.74% 55 45.00 N/A 1000 25000First Option Credit Union Standard Visa Credit Card

13.49% 45 18.00 N/A 500 20000GE Money 28 Degrees MasterCard

20.99% 55 0.00 N/A 500 No MaxGreater Building Society Credit Card

10.25% 55 40.00 10000 1000 25000HSBC Credit Card

17.99% 55 0.00 N/A 1000 No MaxIntech Credit Union Titanium Visa 55

12.30% 55 46.00 N/A 1000 30000nab Low Rate Card

13.99% 55 59.00 N/A 500 No MaxNewcastle Permanent Value+ Credit Card

12.24% 55 49.00 N/A 500 20000Qantas Staff CU Lifestyle Plus

15.85% 46 0.00 N/A 1000 50000Qld Police Credit Union Bluey Card

12.74% 55 25.00 8000 1000 25000Queensland Country CredVisa Card

13.20% 55 39.00 N/A 500 No MaxSCU Low Rate Visa Credit Card

10.49% 55 30.00 N/A 1000 No MaxSelect Credit Union Super Credit Card

10.99% 55 30.00 N/A 1000 20000Westpac Low Rate MasterCard/Visa

13.49% 55 45.00 N/A 1000 30000

ANZ Balance Visa

14.39% 55 79.00 N/A 1000 15000ANZ First

19.39% 44 30.00 N/A 1000 No MaxBank of Melbourne Amplify Credit Card

18.74% 55 79.00 N/A 1000 80000Bank of Melbourne Gold Low Rate MasterCard/Visa

15.99% 55 79.00 N/A 4000 80000Bank of Melbourne No Annual Fee MasterCard/Visa

20.49% 0 0.00 N/A 500 40000Bank of Melbourne Vertigo MasterCard

13.24% 55 55.00 N/A 500 40000bankmecu Low Rate Visa CreditCard

10.39% 0 59.00 N/A 1000 No MaxBankSA Amplify Credit Card

18.74% 55 79.00 N/A 1000 80000Report Date: 2/05/2013, (All information is correct as at April 15th, 2013) Credit Card Star Ratings 2013 - page 13

your guide to product excellence

Credit Card Star Ratings

Spend to

Waive

Annual Fee

Rate

(as at

26/10/12)

Free

Days

AnnualisedFee

Report Date: April 2013

Annual Fee ($)

(as at 26/10/12)

Product

MaximumCredit Limit ($)

Minimum

Rewards

Program

Availabe

We endeavour to include the majority of product providers in the market and to compare the product features most relevant to

consumers in our ratings. This is not always possible and it may be that not every product in the market is included in the rating nor

every feature compared that is relevant to you

OCCASIONAL SPENDER

Company

BankSA Gold Low Rate MasterCard/Visa

15.99% 55 79.00 N/A 4000 80000BankSA No Annual Fee MasterCard/Visa

20.49% 0 0.00 N/A 500 40000BankSA Vertigo MasterCard

13.24% 55 55.00 N/A 500 40000Bankwest More MasterCard

19.49% 55 49.00 N/A 1000 25000Bankwest Qantas Classic MasterCard

19.49% 55 49.00 N/A 1000 No Maxbcu Classic Visa Card

11.80% 55 40.00 N/A 500 No MaxBendigo Bank RSPCA Rescue Rewards

19.64% 55 60.00 N/A 500 50000BOQ Low Rate Visa Card

13.49% 55 55.00 N/A 2000 20000Coastline Credit Union Visa Credit Card

17.50% 0 0.00 N/A 500 No MaxCoastline Credit Union Visa Rewarder

17.00% 55 52.00 12000 1000 25000Coles Coles MasterCard

19.99% 62 49.00 N/A 500 No MaxCommonwealth Bank Low Fee Gold MasterCard

19.74% 55 90.00 10000 4000 No MaxCommonwealth Bank Low Rate Gold MasterCard

12.99% 55 120.00 N/A 4000 No MaxCommonwealth Bank Standard Awards

20.24% 55 89.00 N/A 500 No MaxCredit Unions* Low Rate MasterCard

12.99% 55 75.00 N/A 2000 15000CUA Low Rate MasterCard

12.99% 55 75.00 N/A 2000 15000ECU Australia Low Rate Visa Credit Card

13.50% 55 48.00 N/A 1000 50000Encompass Credit Union Visa Credit Card

15.00% 55 36.00 N/A 1000 5000First Option Credit Union Cash Rewards Visa Credit Card

15.99% 45 36.00 N/A 500 20000GE Money Low Rate MasterCard

15.49% 55 58.00 N/A 500 No MaxHeritage Bank Visa Classic Basic

16.75% 55 18.00 10000 1000 10000Hume Building Society Loyalty

17.95% 55 30.00 8000 500 20000Hunter United Credit Un Visa Credit Card

11.49% 55 59.00 N/A 1000 20000Jetstar MasterCard

13.99% 55 59.00 N/A 2000 50000ME Bank MasterCard

12.25% 44 49.00 7500 1000 15000nab Low Fee MasterCard

19.49% 44 30.00 N/A 500 No Maxnab Qantas Rewards

19.99% 44 65.00 N/A 500 500000nab Velocity Rewards

19.99% 44 65.00 N/A 500 No MaxP&N Bank Easypay Visa

11.99% 45 40.00 N/A 500 No MaxPeople's Choice Credit UnCharity Credit Card

15.95% 62 40.00 N/A 1000 No MaxPeople's Choice Credit UnVisa Credit Card

15.95% 62 40.00 N/A 1000 No MaxQld Police Credit Union Bluey Rewarder Card

15.74% 55 48.00 8000 1000 25000SGE Credit Union Classic Solutions

12.95% 45 50.00 N/A 1000 10000St.George Bank Amplify Credit Card

18.74% 55 79.00 N/A 1000 80000St.George Bank Gold Low Rate MasterCard/Visa

15.99% 55 79.00 N/A 4000 80000St.George Bank No Annual Fee MasterCard/Visa

20.49% 0 0.00 N/A 500 40000St.George Bank Vertigo MasterCard

13.24% 55 55.00 N/A 500 40000Suncorp Bank Standard Card

12.74% 0 55.00 N/A 2000 20000Virgin Money No Annual Fee Credit Card

18.99% 44 0.00 N/A 2000 10000Westpac 55 day MasterCard/Visa

19.59% 55 30.00 10000 1000 30000Westpac Altitude

19.99% 45 100.00 N/A 1000 30000Westpac earth

19.99% 45 75.00 N/A 1000 No Max

American Express Qantas Discovery Card

20.74% 44 0.00 N/A 2000 100000ANZ Frequent Flyer

19.39% 44 95.00 N/A 1000 No MaxReport Date: 2/05/2013, (All information is correct as at April 15th, 2013) Credit Card Star Ratings 2013 - page 14

your guide to product excellence

Credit Card Star Ratings

Spend to

Waive

Annual Fee

Rate

(as at

26/10/12)

Free

Days

AnnualisedFee

Report Date: April 2013

Annual Fee ($)

(as at 26/10/12)

Product

MaximumCredit Limit ($)

Minimum

Rewards

Program

Availabe

We endeavour to include the majority of product providers in the market and to compare the product features most relevant to

consumers in our ratings. This is not always possible and it may be that not every product in the market is included in the rating nor

every feature compared that is relevant to you

OCCASIONAL SPENDER

Company

ANZ Rewards

19.39% 44 89.00 N/A 1000 No Maxbcu Visa Bonus Rewarder

16.80% 55 40.00 N/A 500 No MaxBendigo Bank Ready Red MasterCard/Visa

19.99% 44 45.00 N/A 500 50000BOQ Blue Visa

20.74% 44 60.00 N/A 2000 7500Commonwealth Bank Gold Awards

20.24% 55 144.00 N/A 4000 No MaxGE Money eco MasterCard

20.49% 55 49.00 N/A 500 20000GE Money Gem Visa

22.99% 55 99.00 N/A 1000 No MaxGE Money GO MasterCard

21.74% 62 59.00 N/A 1000 25000Heritage Bank Visa Classic Rewards

16.75% 55 48.00 N/A 1000 10000HSBC Classic Credit Card

20.50% 55 59.00 N/A 1000 No MaxMacquarie Bank Visa Gold Card

20.95% 55 130.00 N/A 2000 50000Macquarie Bank Visa RateSaver Card

14.95% 55 69.00 N/A 2000 50000Myer Myer Visa Card

20.69% 62 69.00 N/A 1000 No MaxWoolworths Limited Everyday Money

19.84% 55 49.00 N/A 1000 No Max

American Express David Jones Card

20.74% 44 99.00 N/A 2000 25000American Express Platinum Edge Credit Card

20.74% 55 149.00 N/A 3000 50000American Express Platinum Reserve Credit Card

20.74% 55 395.00 N/A 3000 50000American Express Velocity Gold Card

20.74% 44 199.00 N/A 3000 50000American Express Velocity Platinum Card

20.74% 44 349.00 N/A 3000 100000SERVICE ONE Members BVisa

15.25% 0 0.00 N/A 500 10000*Credit Unions includes the following financial institutions: Catalyst Mutual

Community CPS Australia

Companion CU

FCCS Credit Union

Holiday Coast CU

Illawarra CU NSW

IMB

MyState Financial

QT Mutual Bank

Queenslanders CU

SERVICE ONE Members Bank

Sutherland Credit Union

Unicredit-WA

Report Date: 2/05/2013, (All information is correct as at April 15th, 2013) Credit Card Star Ratings 2013 - page 15

your guide to product excellence

Report Date: 2/05/2013, (All information is correct as at April 15th, 2013) Credit Card Star Ratings 2013 - page 16

your guide to product excellence

YOUR GUIDE TO PRODUCT EXCELLENCE

What are the CANSTAR

credit card star ratings?CANSTAR

credit card star ratings are a sophisticated rating methodology, unique to CANSTAR, which compare thedominant credit card products in Australia and present the results in a simple, user-friendly format.

Our rating methodology is transparent and extensive. The methodology compares all types of personal unsecured

credit cards in Australia and accounts for an array of characteristics such as;

Fees/Interest Rates No Free Days Standard Features

Premium Features Reward/Loyalty Programs No FrillsThe results are reflected in a consumer-friendly 5-star concept, with five stars denoting a product that offers

outstanding value.

What are the Profiles used by CANSTAR credit card star ratings?

CANSTAR appreciates that credit card users have different spending habits and therefore value different aspects of

their credit card. In recognition of these differences, the CANSTAR

credit card star ratings methodology has beenmodified to reflect a range of spending styles and credit card usage.

Profile Name Description

Big Spender

Do you Spend $5000 each month and then pay of your balance?Everyday Spender

Do you Spend $2000 each month and then pay of your card?Occasional Spender

Do you make the occasional big purchase and then slowly pay it off?Habitual Spender

Do you keep spending on your credit card before you have paid itoff?

CANSTAR has adopted four different credit card user profiles in an attempt to cover the majority of card spending and

payment patterns. The star ratings methodology differs for each profile in terms of the relative importance placed on

the fees and features of the cards assessed. For example the methodology recognises that interest rates will be more

important to someone who rarely pays off their card balance each month than they will be for someone who always

pays the balance owing on their card.

How does it work? How are the ‘

stars’ calculated?Each credit card reviewed for the CANSTAR

credit card star ratings is awarded points for its comparative Costs andfor the array of positive Features attached to the card. These features include rewards programs, premium card

facilities, repayment capabilities and conditions attached to interest charging.

To arrive at the total score CANSTAR applies a weight (w) against the Cost score (C) and the Features score (F).

This weight will vary for each profile of credit card usage. The weight will reflect the relative importance of either costs

or features in determining the best card for the type of credit card usage and payment.

W1 COST SCORE

( C ) + W2 FEATURES SCORE ( F ) = TOTAL SCORE ( T )METHODOLOGY

YOUR GUIDE TO PRODUCT EXCELLENCE

2COST FEATURES

Profiles COST Cost over

12 months

Historical

Rates

FEATURES Product

features

Free days Min

Repayment

Habitual Spender

70% 50% 50% 30% 83% 0% 17%Occasional

Spender

60% 70% 30%

40% 87% 13% 0%Everyday Spender

35% 70% 30% 65% 90% (-2%) 10% (+2%) 0%Big Spender

25% 70% 30% 75% 90% 10% 0%Costs (C)

CANSTAR compares both current and historical credit card pricing data to calculate the COST (C) component of each product’s overall score. Current data is used to calculate the annual cost to the cardholder for using each card. The cost of each card varies depending on the characteristics of the spending profile. Below are some of the spending and revolving details used in the calculation of the cost of each credit card.

1) Current Data –includes a scenario for each of the four credit card spending profiles

Habitual Spender - spends $12,000 per year while revolving $6,000 (+$1000)

Everyday Spender - spends $24,000 per year and revolves $3000 for one month

Occasional Spender - spends $6,000 per year and revolves $750 four times a year

Big Spender - spends $60,000 per year and revolves $9,000 for one month2) Historical Performance of Interest Rate – takes into account the product history in the last 6 months.

Features (F)

Each card Feature (F) is allocated points. Points are awarded for positive credit card traits such as no fees or greater

flexibility. The total features score for each category of information (eg repayment capabilities) is ranked and

weighted with each category contributing to the overall Features Score (F). As Features are relatively static, they are

not measured over time.

Weightings

The Costs and Features are weighted differently for each spending profile. This is done in recognition of the relative

importance of the different product components to each profile.

The methodology for each profile is subtly adjusted to account for the differences between them. The process

considers each profile separately and assigns weights representative of that profile (see table below). For the

Habitual spender for example, the rates and fees associated with a card account for 70% of that card’s total score and

Indexed Score

Product with the best pricing or

features will receive a full score

Cost Score

25-70%

Feature Score

30-75%

Cost over 12 months

Includes current interest rate & annual fee

Historical interest rates

6 months historical interest rates

Features

Eg, reward schemes, security

Min Repay/Int Free Days

Weightings:

YOUR GUIDE TO PRODUCT EXCELLENCE

3the features account for the remaining 30%. The cards targeting this user demographic have fewer features, less

flexibility and compete mainly on pricing. The cards targeting the Big Spender on the other hand (eg. Gold, Platinum

or rewards cards) typically offer more features. The Big spender profile has therefore been adjusted so that features

account for 75% of the total score, while rates and fees account for 25%.

The Costs (C) plus Features (F) point scores are indexed and totalled to provide the Total Index Points. Together

they form the basis of the CANSTAR’s credit card star ratings.

FEATURES WEIGHTS USED IN STAR RATINGS SCORING

FEATURES CATEGORY

HABITUAL

SPENDER

OCCASIONAL

SPENDER

EVERYDAY

SPENDER BIG SPENDER

ADDTNL FEES & CHARGES 13%

(+2%) 20% 5% 4.5%CARD TERMS 20% 15% 7% 6%

LATE PYMT INT CHARGING 16%

(+4%) 15.5% (+3.5%) 11.5% 10%MERCHANT ACCEPTABILITY 14% 15% 9.5% 8%

CARD SECURITY 14% 15% 6.5% 5.5%

PREMIUM CARD FACILITIES 3% 3% 15.5%

(+1%) 22%REPAYMENT CAPABILITIES 7% 5% 3.5% 3%

REWARDS PROGRAM 3.5% 3.5% 35%* 35%**

SPECIAL PURCHASING POLICIES 9%

(-6%) 3 (-3.5%) 3% (-1%) 3%APPLICATION PROCESS 6.5% 5% 3.5% 3%

*based on $24k rewards star ratings (for companion cards, 35% of weight allocated to AMEX program, 65% to Visa/MasterCard)

**based on $60k rewards star rating ( for companion cards, 40% of weight allocated to AMEX program, 60% to Visa/MasterCard)

How are the stars awarded?

The total score received for each profile ranks the products. The stars are then awarded based on the distribution of

the scores according to the following guidelines. As you can see, only the products that obtain a score in the top 10%

of the of the score distribution receive a 5 star rating.

The results are reflected in a consumer-friendly CANSTAR star rating concept, with five stars denoting outstanding

value.

Does CANSTAR rate all products available in the market?

We endeavour to include the majority of product providers in the market and to compare the product features most

relevant to consumers in our ratings. However this process is not always possible and it may be that not every product

in the market is included in the rating nor every feature compared that is relevant to you.

How many products and financial institutions are analysed?

In order to calculate the ratings, CANSTAR analyses 212 Credit Card products from 53 financial institutions in

Australia. In addition, over 100 parts of a product are analysed which includes product parameters, flexibility and

YOUR GUIDE TO PRODUCT EXCELLENCE

4operating terms and conditions.

How often are CANSTAR

credit card star ratings re-rated?All ratings are fully recalulated every six months based on the latest features offered by each institution. CANSTAR

also monitors rate changes on an ongoing basis.

Does CANSTAR rate other product areas?

CANSTAR researches, compares and rates the suite of banking and insurance products listed below. These star

ratings use similar methodologies to guarantee quality, consistency and transparency. Results are freely available to

consumers who use the star ratings as a guide to product excellence. The use of similar star ratings logos also builds

consumer recognition of quality products across all categories. Please access the CANSTAR website at

www.canstar.com.au

if you would like to view the latest star ratings reports of interest.DISCLAIMER:

To the extent that any CANSTAR data, ratings or commentary constitutes general advice, this advice has been prepared by CANSTAR Pty Ltd ABN 21

053 646 165 AFSL 312804 and does not take into account your individual investment objectives, financial circumstances or needs. Information provided

does not constitute financial, taxation or other professional advice and should not be relied upon as such. CANSTAR recommends that, before you

make any financial decision, you seek professional advice from a suitably qualified adviser. A Product Disclosure Statement relating to the product

should also be obtained and considered before making any decision about whether to acquire the product. CANSTAR acknowledges that past

performance is not a reliable indicator of future performance. Please refer to CANSTAR’s FSG for more information at www.canstar.com.au.

All information contained herein shall not be copied or otherwise reproduced, repackaged, further transmitted, transferred, disseminated, redistributed or

resold, or stored for subsequent use for any purpose, in whole or in part, in any form or manner or by means whatsoever, by any person without

CANSTAR’s prior consent. All information obtained by CANSTAR from external sources is believed to be accurate and reliable. Under no

circumstances shall CANSTAR have any liability to any person or entity due to error (negligence or otherwise) or other circumstances or contingency

within or outside the control of CANSTAR or any of its directors, officers, employees or agents in connection with the procurement, collection,

compilation, analysis, interpretation, communication, publication, or delivery of any such information. Copyright 2012 CANSTAR Pty Ltd ABN 21 053

646.

•

Agribusiness•

Business banking•

Business life insurance•

Car insurance•

CFD trading•

Credit cards•

Deposit accounts•

Direct life insurance•

Health insurance•

Home & Contents•

Home loans•

Life Insurance•

Low-doc home loans•

Margin lending•

Online Banking•

Online Share Trading•

Package banking•

Personal loans•

Reward programs•

Travel insurance